… which you’re welcome to take or leave.

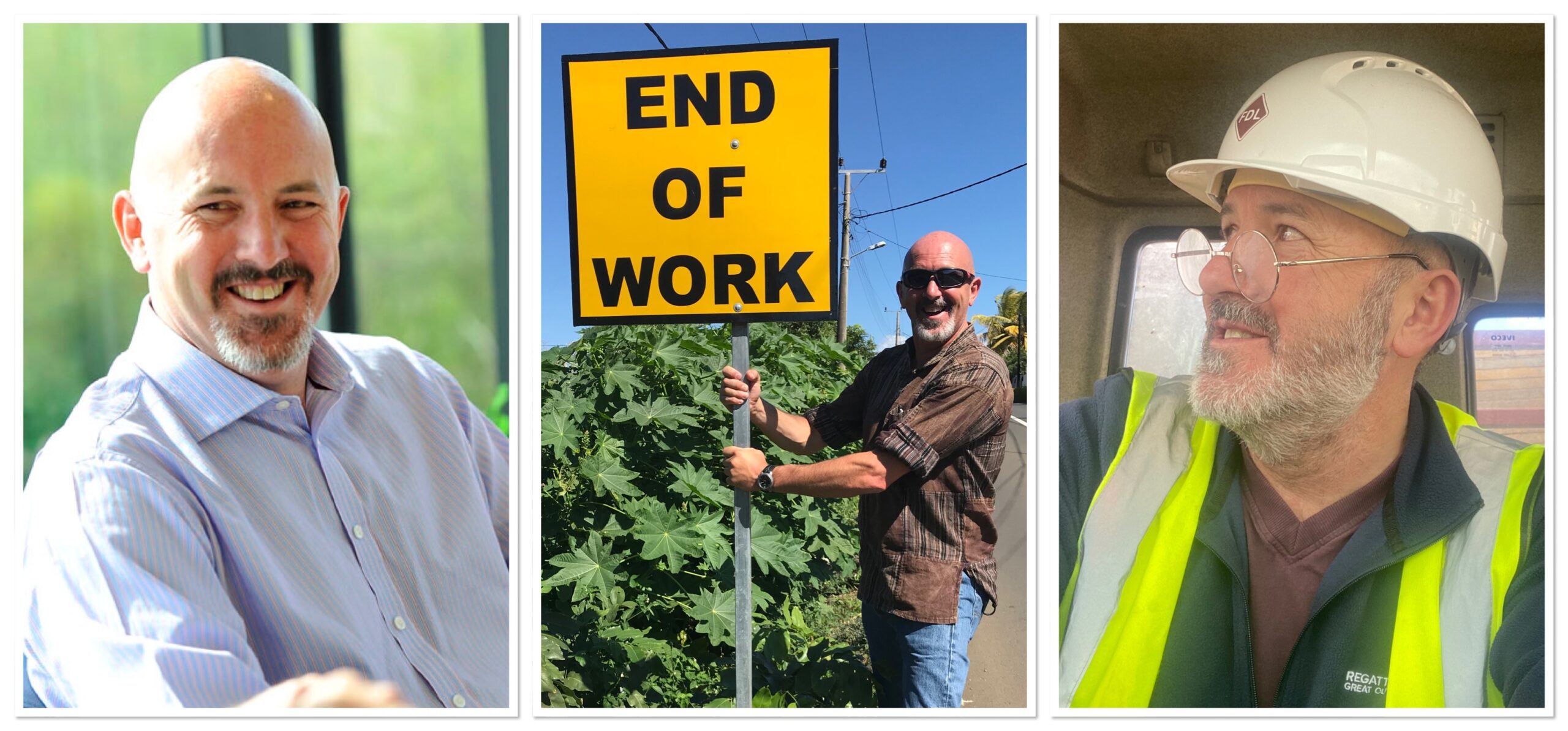

Don’t work till you drop

I’ve never succumbed to the notion of “work till you drop” and have always had a closer eye than most on an ‘early’ retirement. Growing up, I recall listening to stories of people who had shuffled off to ‘meet their maker’ within a few short years of stopping work, I think this had an impact on me.

Even in the late 1980s when I was in my early twenties, I distinctly remember being asked by a pensions adviser “what age do I plan to finish my career” as he wanted to run some calculations; I didn’t hesitate – it was between 50 and 55.

I had a plan in my head from the very get go, and the last decade of my professional working life only increased my level of determination, especially as my income had luckily increased.

Indeed, in the final four or five years of my career I invested huge chunks of my earnings into my pension plan, maximising my personal allowance and government contributions to the absolute limit.

For years, my personal pension contribution floated at around 30% of my salary, there were even short periods when this peaked at well over 50% – especially when I was earning well. That was until I reached the target I had set!

During these periods I didn’t have oodles of spare cash and lived a relatively frugal life. But I was focused on what I wanted to achieve and it was worth the short term pain.

It’s been tough on other fronts too, especially as I’ve been through two divorces, the first of which took a fifty percent slice of my pension, and the second, around a quarter. But I don’t begrudge those for one minute, that’s part of the marriage contract, and I could argue both focused my mind on resetting my pension priorities so, in a perverse way, they helped.

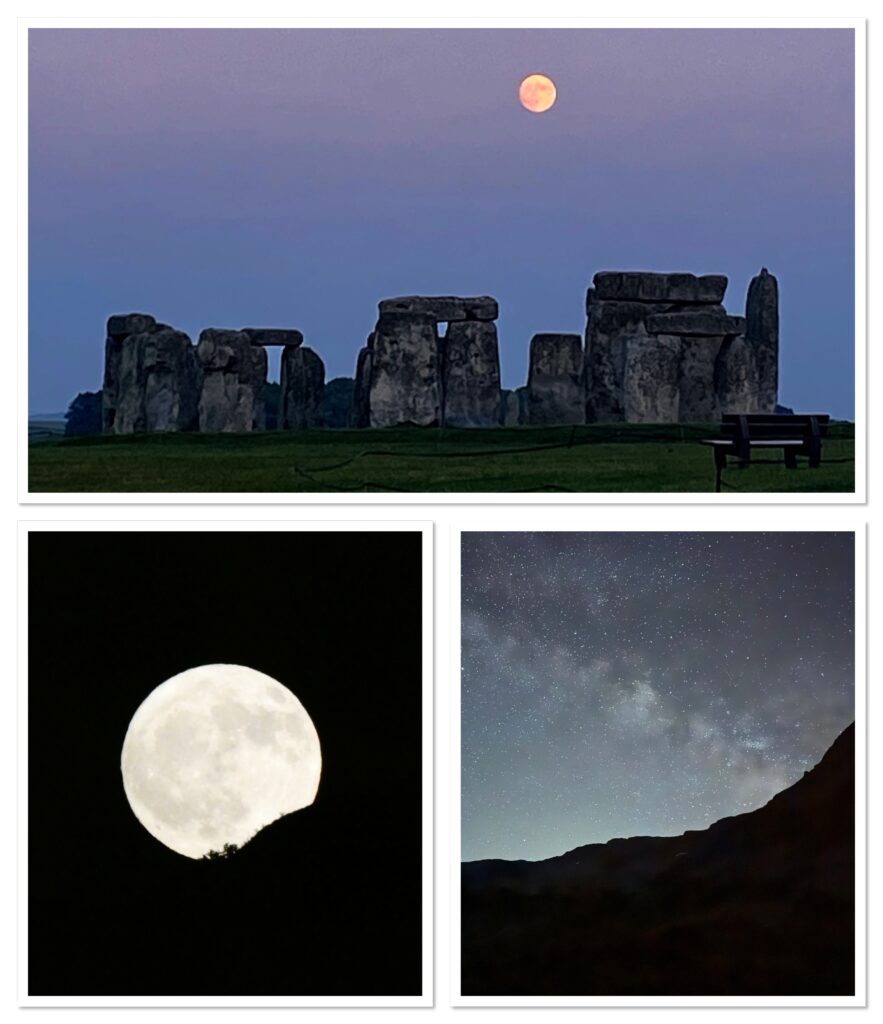

Put things into perspective

On a full moon and when the sky is clear, I stop what I’m doing, pause and look up.

Every time I do so it puts me, and my place in this world, into perspective. A tiny spec of life, standing on a ball of rock and molten lava, floating in a universe, amongst countless billions of stars and other planets. The wars we are fighting, and the reasons for doing so all seem rather pointless and irrelevant when viewing things on a cosmic scale.

I am a classic over-thinker, over analysing minutiae and worrying about trivia – always have been, but thoughts like this help me recalibrate.

So why am I talking about the moon? Well, I am 59 years of age and if I manage to live the ‘average’ lifespan of a man (81 in the UK), between now and the day I die, I will only have the opportunity to see the full moon in all its glory around 140 more times. That calculation is based on the full moon cycle over the next 22 years, minus cloud cover (data from various meteorological websites).

So I stop and look up – every time!

Time is precious

I try not to waste a single day or weekend either.

If I’m lucky, I have got just over a thousand weekends left before I ‘pop my clogs’ (well 1,144 to be precise). That is why I am always as keen as mustard to get out and do something, listen to live music, meet people, visit somewhere different to take in a view, or travel somewhere further and experience something new. We live on an amazing planet and there is so much out there to see and do. There is nothing I get frustrated about more than a weekend, or day which is ‘lost’. So I set out to “win” them, as much as I possibly can.

One day, I won’t have the energy or ability to climb mountains or go on long cycling trips, and I may no longer want to “rough it” in hostels. This drove my decision to retire early and seize each opportunity now, whilst I still can.

Some advice – based on my journey

To anyone reading this, especially those still in work, my advice would be:

- Have a plan: and start a contributory pension plan.

- Contribute more than the minimum: ALWAYS invest way more than the minimum amount that your employer automatically sets. Double it, or go higher if allowed. Pensions contributions come off gross salary so aren’t subject to tax and NI. The government also hands you a top-up contribution, and depending on your tax bracket this could result in a 20% or 40% increase. Think about it, that’s insane, where else would you get that immediate level of guaranteed increase on top of your initial investment? …and from the government!

- Start early – compound growth has an amazing impact on long term investments – especially pensions. So the earlier you invest, the better!

- Know your target: Understand the size of the pension pot you are aiming to save and use every ounce of your personal allowance to get there; that cash for a new car or push-the-boat-out holiday might just be better off going into your pension. The earlier deposits can be made, the more you will benefit from compound growth, which over the long term will make a huge impact.

- Stay on track: Even if life derails you, keep your end goal in mind.

- Know when enough is enough: Don’t trade life experiences for a bigger pension once you’ve reached your target. It’s daunting I know, but if you’ve done the maths and are able to go with the ebb and flow of the markets over the longer term – have faith in the numbers.

- Retire early: and do the stuff your mind or body won’t allow you to do in later years.

- Seek good pension advice: you wouldn’t buy a car without some really good due diligence, so make sure you shop around.

I could go on, but you get the drift.

The big leap.

A big part of my retirement plan was understanding how much I need to spend during the remainder of my lifetime – now that’s a BIG question!

So I calculated my monthly expenditure for both essentials and the lifestyle I wanted – obviously the latter was influenced by what I had could afford. I had to consider a wide range of stuff including inflation, tax, mortgage payments, bills, other investments, the impact of state pension (when that kicks in), along with my pension portfolio performance and my own risk appetite.

The beauty of modern drawdown pensions is that they are incredibly flexible. My personal preference is to drawdown a pension in 12 equal monthly instalments, mimicking a salary. This approach limits the speed at which the pot is reduced and allows for its continued investment and possible growth. The upside, is that over the long term (taking history as a yardstick), pension plans perform very well and do indeed grow higher than most other forms of investment vehicles. The downside is that there will be years when they don’t – the trick here is not to panic.

Staying at work may have provided more financial security and allowed me to grow my pension pot further, but it would have meant sacrificing life experiences.

So in 2021, and at the age of 56 I did the maths and decided I could afford to make my first move towards retirement. Things happening on the work front, my personal life and the COVID disaster made this decision even easier!

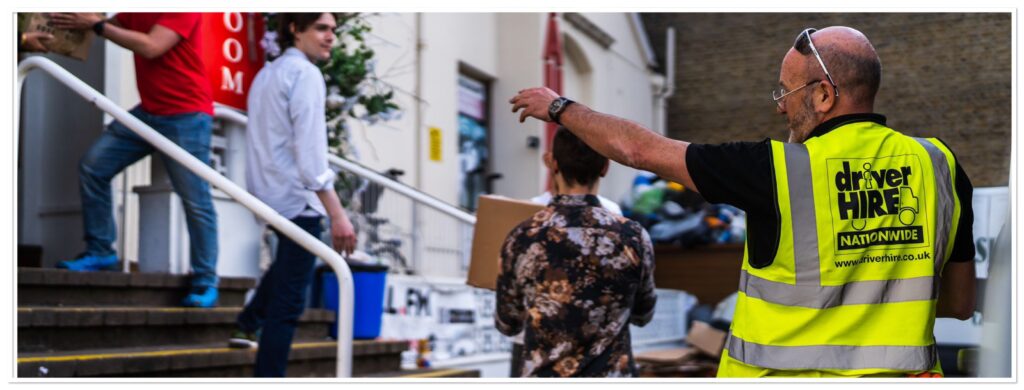

Fall back plan

After I stepped away from my main career, I retrained and got myself a HGV license, mainly as a safety net.. I have always loved driving and was excited to experience life on the road. On balance I think was a good idea as it gave me the confidence I required at the time, but with hindsight it wasn’t essential.

So for a few years I worked part-time, driving trucks, somewhere between eight and ten days a month. This allowed me to keep afloat, fund specific expenses (trips), and defer the formal drawdown initiation date (allowing for a few years more growth). It also felt good to have a HGV licence in my back pocket to help manage any gap in my pension for those years when the markets under-perform.

Working in the gig economy on a zero hours contract suited me perfectly, allowing me to control when and how often I worked. This flexibility provided peace of mind without the stress and commitment of a full-time job or consultancy.

That’s when I started to travel.

So here I am…

I wanted to add this chapter to my travel blog mainly because I’m often asked how I manage to fund my trips and have the time to do what I love at this stage of my life. It may look to some that I am minted, but I’m not. I have and always will be working class and I’ll remain a Trade Union member until the day I die.

Honestly, it mainly comes down to having a plan with pensions at the heart of it. I stuck with that plan steadily throughout my career, accelerating my contributions in the final years.

If I could start over, I might’ve contributed even more from the outset, even knowing that divorce(s) would cut into those savings. For me, my pension has been the single most valuable financial tool I’ve had.

In my view, pension and retirement planning deserves more attention in school, the workplace, or from the government. My own route to pension planning initially came about by chance. I owe much of it to my father, who, by luck and some foresight, managed an early retirement himself. He started work at fifteen on the London docks, transferred his pension to his next job as a municipal worker, and then finally into the fire service. It worked out for him in the public sector, as it has done for me in the private sector (with a lot of sacrifice and saving) but it’s a journey that could be made much clearer for all.

I hope this post inspires someone to pick up even one or two of the lessons I learned on this journey. If so, I’ll be happy.

Anyway, if I’m still around and traveling in twenty or more years, I’ll update you on how it all worked out.

Fingers crossed, and happy travels!

Hints and Tips

Seeing as most of my blogs have links to hostels, hotels, airlines and other tips for travel, I’ll leave the details of my financial chap below. I found him through an Internet search about four or five years ago. I selected him over others, from a shortlist I worked up based on a set of criteria that was important to me. Like I say on my homepage, I don’t get any kick backs from any of the links I provide. I do this blog purely for fun and to share experiences. His name is: Guy Stout, he’s a Chartered Financial Planner, working for an organisation called Doyle and Palmer. Mobile 07765 408320. Office 01329 227421.

My advice is for you to run your own ‘beauty parade’ of financial advisers and after due diligence, run with the one that you like the most.

It’s important that they understand your personal needs and have good rates (the latter is important – even a small fee difference of 0.5% adds up over time). It’s also amazing how the quality differs is out there so put the effort in your search, and go with your instinct. It also should go without saying, beware of scammers, and make sure the your advisor is genuine go to FCA website to check and call them on their published number and perform all the usual checks.